Amazingly, a recent NerdWallet.com study showed that a large majority of insurance policyholders in Kentucky have been with the same company for four years or more, and 38% of customers have never compared rates with other companies. U.S. insurance shoppers can cut their rates by as much as 47% a year, but most just don’t grasp how much money they would save if they just switched companies.

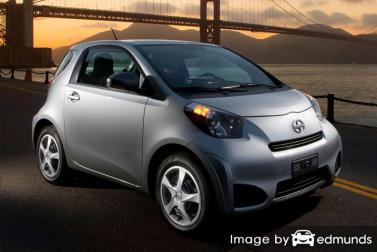

The recommended way to get the cheapest Scion iQ insurance is to compare prices at least once a year from insurance carriers in Louisville. Rates can be compared by following these steps.

The recommended way to get the cheapest Scion iQ insurance is to compare prices at least once a year from insurance carriers in Louisville. Rates can be compared by following these steps.

- Get an understanding of auto insurance and the steps you can take to drop your rates. Many rating factors that drive up the price such as at-fault accidents, speeding tickets, and a negative credit rating can be eliminated by being financially responsible and driving safely. Later in this article we will cover more details to get cheaper rates and find overlooked discounts.

- Request rate estimates from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only give prices from one company like GEICO or State Farm, while independent agents can provide rate quotes from multiple companies. Select a company

- Compare the new rate quotes to the price on your current policy to determine if you can save on iQ insurance. If you find a lower rate, make sure coverage does not lapse between policies.

- Tell your current agent or company to cancel your current auto insurance policy and submit payment and a signed application to your new insurance company. Once received, keep your new proof of insurance certificate along with the vehicle’s registration papers.

An essential thing to point out is that you’ll want to compare similar coverage information on each quote and and to get price quotes from as many companies as feasibly possible. Doing this helps ensure an accurate price comparison and a complete selection of prices.

Cheapest companies for Scion iQ insurance

The companies in the list below are ready to provide free quotes in Louisville, KY. If your goal is to find the best auto insurance in Louisville, we suggest you click on several of them to get the best price comparison.

Save money by taking advantage of discounts

Car insurance can be pricey, but companies offer discounts that could help you make your next renewal payment. Certain credits will be shown when you purchase, but some discounts are required to be asked for prior to getting the savings.

- Data Collection Discounts – People who choose to allow driving data collection to track when and where they use their vehicle remotely such as Drivewise from Allstate or Snapshot from Progressive could possibly reduce rates if they show good driving skills.

- Seat Belts Save – Using a seat belt and requiring all passengers to use their safety belts could save 15% off the PIP or medical payment premium.

- Distant College Student Discount – College-age children living away from Louisville attending college and don’t have a car may qualify for this discount.

- Theft Deterrent Discount – Cars equipped with tracking devices and advanced anti-theft systems help deter theft and can earn a small discount on your policy.

- Discount for Passive Restraints – Options like air bags may qualify for discounts of 20% or more.

- Professional Organizations – Participating in qualifying clubs or civic groups may earn a discount when shopping for car insurance.

- Discount for Multiple Policies – If you combine your auto and homeowners policies with the same company you could save over 10 percent off each policy depending on the company.

- Savings for New Vehicles – Buying a new car model can get you a discount compared to insuring an older model.

- Payment Discounts – If you can afford to pay the entire bill instead of monthly or quarterly installments you can avoid monthly service charges.

It’s important to note that most discount credits are not given to your bottom line cost. Some only apply to the cost of specific coverages such as medical payments or collision. So even though you would think you could get a free car insurance policy, companies don’t profit that way.

Larger car insurance companies and their offered discounts are included below.

- Progressive may offer discounts for online signing, online quote discount, continuous coverage, multi-vehicle, good student, and homeowner.

- MetLife may have discounts that include multi-policy, accident-free, defensive driver, good driver, claim-free, and good student.

- Mercury Insurance offers discounts including low natural disaster claims, anti-theft, good driver, location of vehicle, and good student.

- Nationwide offers discounts for family plan, multi-policy, Farm Bureau membership, good student, business or organization, and defensive driving.

- GEICO has savings for membership and employees, anti-lock brakes, defensive driver, multi-vehicle, driver training, and daytime running lights.

- AAA includes discounts for anti-theft, good student, education and occupation, good driver, multi-policy, pay-in-full, and AAA membership discount.

When quoting, ask all companies you are considering the best way to save money. Savings may not apply to policies in Louisville. To locate providers with the best discounts in Louisville, click here.

Independent versus exclusive insurance agencies

Many people just prefer to go talk to an agent and that can be a great decision Good agents can answer important questions and help in the event of a claim. A good thing about comparing rate quotes online is that you can find cheap rate quotes and still have an agent to talk to. Buying insurance from local agents is important especially in Louisville.

Upon completion of this short form, your insurance data is immediately sent to companies in Louisville that can provide free Louisville car insurance quotes to get your business. It makes it easy because there is no need to leave your house since price quotes are sent directly to you. In the event you want to compare rates for a specific company, feel free to search and find their rate quote page to submit a rate quote request.

Compare rates from both independent and exclusive car insurance agents

When finding a local agent, you must know there are a couple different types of agents to choose from. Car insurance policy providers are considered either exclusive or independent (non-exclusive). Both sell car insurance policies, but it’s a good idea to understand the difference between them because it can influence which agent you choose.

Independent Car Insurance Agents

These agents often have affiliation with several companies and that allows them to write policies through many different car insurance companies and possibly get better coverage at lower prices. If they quote lower rates, they simply move your policy to a different company which makes it simple for you. If you need lower rates, you absolutely need to contact at least one independent agent to have the best price comparison. Most have the option of insuring with different regional companies which can be an advantage.

Featured below is a list of independent insurance agents in Louisville that may be able to give you rate quotes.

- Logan, Stanley – Logan Lavelle Hunt Insurance

11420 Bluegrass Pkwy – Louisville, KY 40299 – (502) 499-6880 – View Map - Dolack Insurance Agency Inc.

4050 Westport Rd – Louisville, KY 40207 – (502) 333-0577 – View Map - Phil Brown Insurance Agency, Inc.

9300 Shelbyville Rd #1004 – Louisville, KY 40222 – (502) 327-6966 – View Map

Exclusive Agents

Agents of this type can only provide one company’s prices such as Allstate, Farmers Insurance or State Farm. Exclusive agents cannot compare other company’s rates so it’s a take it or leave it situation. These agents receive extensive training in insurance sales which helps them sell insurance even at higher premiums. Some consumers prefer to use the same exclusive agent mainly due to the brand name rather than having the cheapest rates.

Shown below is a list of exclusive insurance agencies in Louisville that are able to give comparison quotes.

- Jeff Kleier – State Farm Insurance Agent

13303 Magisterial Dr – Louisville, KY 40223 – (502) 882-1855 – View Map - Sam Wheeler – State Farm Insurance Agent

2902 Bardstown Rd – Louisville, KY 40205 – (502) 459-9700 – View Map - Duanne Hawkins Cooper – State Farm Insurance Agent

2152 Glenworth Ave – Louisville, KY 40218 – (502) 458-0258 – View Map

Picking the best insurance agency should depend on more than just the quoted price. These are valid questions to ask:

- Do they receive special compensation for putting your coverage with one company over another?

- Is the agent properly licensed in Kentucky?

- Are they full-time agents?

- How does the company pay claims for a total loss?

- Is coverage determined by price?

- Can glass repairs be made at your home?

- Do you work with a CSR or direct with the agent?

Cover all your bases

Drivers switch companies for many reasons like high prices, policy cancellation, lack of trust in their agent or questionable increases in premium. Regardless of your reason for switching companies, choosing a new company can be pretty painless.

When buying insurance coverage, never reduce needed coverages to save money. There are many occasions where someone sacrificed liability coverage limits to discover at claim time that the few dollars in savings costed them thousands. Your strategy should be to purchase a proper amount of coverage at the best cost and still be able to protect your assets.

Cheaper insurance in Louisville can be found from both online companies and with local Louisville insurance agents, so you should compare both so you have a total pricing picture. There are still a few companies who may not have the ability to get quotes online and usually these smaller providers only sell through independent insurance agencies.

For more information, feel free to visit the following helpful articles:

- Understanding Car Crashes Video (iihs.org)

- What Insurance is Cheapest for a Honda Civic in Louisville? (FAQ)

- Who Has Cheap Auto Insurance for Teachers in Louisville? (FAQ)

- Protecting Teens from Drunk Driving (Insurance Information Institute)

- What is a Telematics Device? (Allstate)

- Steps to Take After an Auto Accident (Insurance Information Institute)