If saving money is your primary concern, then the best way to get budget auto insurance rates in Louisville is to start comparing prices yearly from insurance carriers in Kentucky.

If saving money is your primary concern, then the best way to get budget auto insurance rates in Louisville is to start comparing prices yearly from insurance carriers in Kentucky.

First, spend some time learning about the different coverages in a policy and the things you can change to keep rates down. Many rating criteria that increase rates like multiple speeding tickets and a less-than-favorable credit history can be controlled by making minor changes to your lifestyle. Read the full article for more ideas to find cheap rates and find discounts that you may qualify for.

Second, compare price quotes from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only give prices from a single company like GEICO and State Farm, while independent agents can provide prices for a wide range of insurance providers. View a list of agents

Third, compare the new rate quotes to the price on your current policy and determine if cheaper G5 coverage is available in Louisville. If you find a better price and change companies, ensure coverage does not lapse between policies.

Fourth, provide adequate notice to your current company to cancel the current policy and submit payment and a signed application for your new policy. Once received, place the new proof of insurance paperwork with your vehicle’s registration.

The key aspect of shopping around is to make sure you enter identical coverage information on every price quote and and to get price estimates from every company you can. Doing this provides an apples-to-apples comparison and a thorough selection of prices.

We don’t have to tell you that insurance companies don’t want customers comparing rates. Drivers who shop around at least once a year will, in all likelihood, switch companies because of the high probability of finding a cheaper policy. A recent auto insurance study revealed that drivers who compared prices once a year saved $865 annually compared to drivers who never compared rates.

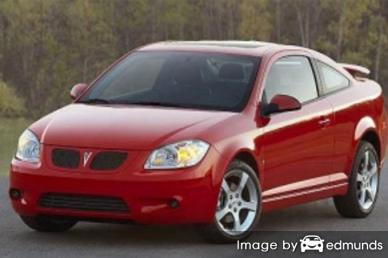

If finding budget-friendly rates on Pontiac G5 insurance in Louisville is your ultimate target, then having some knowledge of how to get rate quotes and compare car insurance can help you succeed in finding affordable rates.

The companies shown below have been selected to offer price quotes in Louisville, KY. If you wish to find the best car insurance in Louisville, KY, it’s highly recommended you visit as many as you can to get a more complete price comparison.

Protect your G5 and other assets

Despite the fact that insurance is not cheap in Louisville, maintaining insurance serves an important purpose.

- Almost all states have minimum mandated liability insurance limits which means it is punishable by state law to not carry a specific minimum amount of liability coverage if you want to drive legally. In Kentucky these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you bought your Pontiac with a loan, more than likely the lender will make it mandatory that you have insurance to ensure the loan is repaid in case of a total loss. If the policy lapses, the lender may insure your Pontiac at an extremely high rate and force you to reimburse them for it.

- Insurance preserves your Pontiac and your assets. It will also pay for medical bills for both you and anyone you injure as the result of an accident. Liability insurance also pays expenses related to your legal defense if you are named as a defendant in an auto accident. If your vehicle suffers damage from an accident or hail, your insurance policy will pay to have it repaired.

The benefits of carrying enough insurance more than cancel out the cost, specifically if you ever have a liability claim. According to a 2015 survey, the average American driver is currently overpaying as much as $865 each year so compare rates every year to ensure rates are inline.

Companies offer many discounts on Pontiac G5 insurance in Louisville

Car insurance is neither fun to buy or cheap, but discounts can save money and there are some available that can help lower your rates. Certain discounts will be triggered automatically when you quote, but some must be asked about prior to getting the savings.

- Passive Restraints – Options like air bags or automatic seat belts can get savings of 25 to 30%.

- Louisville Homeowners Pay Less – Being a homeowner can save a few bucks because owning a home means you have a higher level of financial diligence.

- Telematics Data Discounts – Insureds who allow driving data submission to look at driving patterns by using a telematics device in their vehicle such as Drivewise from Allstate or Snapshot from Progressive could see a rate decrease as long as the data is positive.

- Sign Online – A handful of car insurance companies give back up to $50 for completing your application on the web.

- Safety Course Discount – Taking a class that teaches defensive driver techniques can save you 5% or more depending on where you live.

- Braking Control Discount – Cars that have steering control and anti-lock brakes can reduce accidents and qualify for as much as a 10% discount.

- Discount for Good Grades – Excelling in school could provide a savings of up to 20% or more. This discount can apply up until you turn 25.

We need to note that some credits don’t apply to all coverage premiums. The majority will only reduce specific coverage prices like physical damage coverage or medical payments. Just because it seems like you could get a free car insurance policy, company stockholders wouldn’t be very happy. But any discount should definitely cut your policy premium.

Popular car insurance companies and a selection of discounts include:

- The Hartford offers discounts for bundle, air bag, vehicle fuel type, defensive driver, driver training, and anti-theft.

- American Family discounts include TimeAway discount, bundled insurance, good driver, accident-free, multi-vehicle, defensive driver, and mySafetyValet.

- Progressive offers premium reductions for good student, online quote discount, multi-vehicle, continuous coverage, online signing, homeowner, and multi-policy.

- Travelers may offer discounts for save driver, multi-car, hybrid/electric vehicle, student away at school, IntelliDrive, multi-policy, and good student.

- Farmers Insurance has savings for electronic funds transfer, homeowner, teen driver, multi-car, and alternative fuel.

- USAA may have discounts that include multi-vehicle, annual mileage, vehicle storage, defensive driver, good student, and family discount.

- Liberty Mutual offers discounts including safety features, multi-policy, good student, multi-car, and exclusive group savings.

If you need lower rates, check with all companies you are considering the best way to save money. Some discounts listed above might not be offered on policies in Louisville. To see a list of providers with discount car insurance rates in Kentucky, click this link.

Local neighborhood Louisville car insurance agents

Certain consumers just prefer to visit with an insurance agent and there is nothing wrong with that. Professional agents can help you build your policy and help file insurance claims. One of the benefits of comparing insurance prices online is that drivers can save money and get cheap car insurance rates and still buy from a local agent.

To help locate an agent, after submitting this simple form, the quote information is instantly submitted to participating agents in Louisville that give free quotes and help you find cheaper coverage. There is no need to contact an agency since price quotes are sent immediately to you. If you want to compare rates from a specific insurance company, don’t hesitate to search and find their rate quote page and fill out their quote form.

To help locate an agent, after submitting this simple form, the quote information is instantly submitted to participating agents in Louisville that give free quotes and help you find cheaper coverage. There is no need to contact an agency since price quotes are sent immediately to you. If you want to compare rates from a specific insurance company, don’t hesitate to search and find their rate quote page and fill out their quote form.

Choosing an company should depend on more than just a low price. These are some questions your agent should answer.

- What discounts might you be missing?

- How are claims handled?

- How much will you save each year by using a higher deductible?

- Do you have coverage for a rental car if your vehicle is in the repair shop?

- Is the agency involved in supporting local community causes?

- Is assistance available after office hours?

- Can you choose the body shop in case repairs are needed?

- What is the financial rating for the quoted company?

Not all car insurance agents are the same

When researching a reliable insurance agency, you need to know there are two different types of agencies that differ in how they can insure your vehicles. Car insurance agents are classified as either exclusive agents or independent agents. Both sell and service car insurance coverage, but it’s important to point out the difference in how they write coverage because it can factor into which agent you choose.

Exclusive Car Insurance Agencies

Exclusive agents can only quote rates from one company like Allstate, Farmers Insurance or State Farm. These agents are unable to give you multiple price quotes so they really need to provide good service. Exclusive agents are very knowledgeable in insurance sales which helps offset the inability to provide other markets.

Listed below is a list of exclusive insurance agencies in Louisville who can help you get price quote information.

Tracy Blair Haus State Farm Insurance Agency

11501 Main St – Louisville, KY 40243 – (502) 244-0271 – View Map

Charlton Grant Sr – State Farm Insurance Agent

1802 Farnsley Rd – Louisville, KY 40216 – (502) 448-0202 – View Map

Joe Bell Jr – State Farm Insurance Agent

4016 Preston Hwy – Louisville, KY 40213 – (502) 361-2367 – View Map

Independent Insurance Agents

Independent agencies are not employed by one company so they have the ability to put coverage with multiple insurance companies and help determine which has the cheapest rates. To transfer your coverage to a different company, your agent can just switch to a different company and you don’t have to find a new agent. If you are trying to find cheaper rates, you need to get insurance quotes from multiple independent agents to maximize your price options.

Shown below is a short list of independent insurance agencies in Louisville who can help you get rate quotes.

Family Select Insurance

6409 Dutchmans Pkwy – Louisville, KY 40205 – (502) 454-7283 – View Map

Corey Insurance Agency

3832 Taylorsville Rd #1 – Louisville, KY 40220 – (502) 473-7910 – View Map

Grant Insurance Agency, LLC

13000 Equity Pl #201 – Louisville, KY 40223 – (502) 254-3332 – View Map

Insurance agents can help

When quoting and comparing coverage online or from an agent, there really isn’t a one size fits all plan. Each situation is unique so your insurance needs to address that.

For example, these questions can help discover whether your personal situation might need an agent’s assistance.

- Do I have any recourse if my insurance company denies a claim?

- Why does it cost so much to insure a teen driver in Louisville?

- Do I have coverage when using my vehicle for my home business?

- Are there any extra discounts I can get?

- What does roadside assistance cover?

- Are all vehicle passengers covered by medical payments coverage?

- Is a fancy paint job covered?

If you don’t know the answers to these questions but one or more may apply to you then you might want to talk to a licensed insurance agent. If you don’t have a local agent, take a second and complete this form or you can go here for a list of companies in your area. It only takes a few minutes and may give you better protection.

Car insurance coverage options for a Pontiac G5

Learning about specific coverages of your policy can help you determine the right coverages for your vehicles. The terms used in a policy can be ambiguous and coverage can change by endorsement. Shown next are the normal coverages available from car insurance companies.

Comprehensive car insurance

This covers damage OTHER than collision with another vehicle or object. A deductible will apply and then insurance will cover the rest of the damage.

Comprehensive can pay for claims like damage from a tornado or hurricane, damage from getting keyed, falling objects, theft and fire damage. The maximum payout a car insurance company will pay at claim time is the market value of your vehicle, so if your deductible is as high as the vehicle’s value it’s probably time to drop comprehensive insurance.

Liability auto insurance

Liability insurance provides protection from damages or injuries you inflict on other’s property or people in an accident. Split limit liability has three limits of coverage: bodily injury per person, bodily injury per accident and property damage. You might see policy limits of 25/50/10 which means a limit of $25,000 per injured person, $50,000 for the entire accident, and a limit of $10,000 paid for damaged property.

Liability coverage protects against claims such as repair costs for stationary objects, funeral expenses, bail bonds and structural damage. How much liability should you purchase? That is a decision to put some thought into, but it’s cheap coverage so purchase as much as you can afford. Kentucky requires minimum liability limits of 25/50/10 but drivers should carry more coverage.

The next chart shows why low liability limits may not be enough coverage.

Coverage for medical expenses

Coverage for medical payments and/or PIP kick in for expenses like funeral costs, pain medications, doctor visits, ambulance fees and hospital visits. They can be utilized in addition to your health insurance program or if you lack health insurance entirely. They cover all vehicle occupants and also covers any family member struck as a pedestrian. PIP is not universally available and gives slightly broader coverage than med pay

Coverage for uninsured or underinsured drivers

Your UM/UIM coverage protects you and your vehicle’s occupants from other motorists when they either have no liability insurance or not enough. This coverage pays for medical payments for you and your occupants as well as your vehicle’s damage.

Due to the fact that many Kentucky drivers only carry the minimum required liability limits (Kentucky limits are 25/50/10), it doesn’t take a major accident to exceed their coverage limits. So UM/UIM coverage is important protection for you and your family.

Coverage for collisions

This coverage will pay to fix damage to your G5 resulting from a collision with another car or object. You will need to pay your deductible and then insurance will cover the remainder.

Collision can pay for things such as crashing into a building, damaging your car on a curb, hitting a parking meter and sustaining damage from a pot hole. Collision is rather expensive coverage, so consider removing coverage from vehicles that are 8 years or older. Drivers also have the option to raise the deductible on your G5 to bring the cost down.

Quote more and you will save more

In this article, we covered a lot of tips how to save on Pontiac G5 insurance in Louisville. The key thing to remember is the more rate quotes you have, the better your chances of lowering your prices. You may even find the lowest premium rates are with a company that doesn’t do a lot of advertising. Smaller companies can often insure niche markets at a lower cost as compared to the big name companies such as GEICO and State Farm.

The cheapest Pontiac G5 insurance in Louisville can be purchased online as well as from insurance agents, so you should compare both to have the best selection. Some insurance companies may not offer online price quotes and most of the time these regional carriers work with independent insurance agents.

Helpful information

- Distracted Driving (Insurance Information Institute)

- Who Has the Cheapest Car Insurance Quotes for College Graduates in Louisville? (FAQ)

- Who Has Cheap Car Insurance Quotes for Drivers Over Age 50 in Louisville? (FAQ)

- Who Has the Cheapest Car Insurance for Drivers Over Age 70 in Louisville? (FAQ)

- How Much are Car Insurance Quotes for a Hyundai Elantra in Louisville? (FAQ)

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- Warning systems don’t curb driver distraction (Insurance Institute for Highway Safety)