It’s a fact that car insurance companies don’t want their policyholders to compare prices. Consumers who compare rates at least once a year are highly likely to switch companies because there is a great chance of finding coverage at a more affordable price. Remarkably, a study showed that drivers who make a habit of shopping around saved about $70 a month as compared to drivers who never shopped around for cheaper prices.

It’s a fact that car insurance companies don’t want their policyholders to compare prices. Consumers who compare rates at least once a year are highly likely to switch companies because there is a great chance of finding coverage at a more affordable price. Remarkably, a study showed that drivers who make a habit of shopping around saved about $70 a month as compared to drivers who never shopped around for cheaper prices.

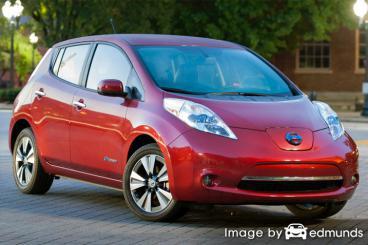

If finding the lowest price for Nissan Leaf insurance in Louisville is your goal, then having a grasp of how to get free comparison quotes and analyze cheaper coverage can make it easier for you to save money.

The recommended way to get discount Nissan Leaf insurance is to start doing an annual price comparison from insurers that insure vehicles in Louisville.

- First, get a basic knowledge of auto insurance and the measures you can take to keep rates low. Many rating criteria that increase rates such as accidents, traffic violations, and poor credit rating can be amended by being financially responsible and driving safely.

- Second, compare prices from exclusive agents, independent agents, and direct providers. Direct companies and exclusive agencies can give quotes from a single company like Progressive or State Farm, while agents who are independent can provide price quotes for a wide range of companies. View rates

- Third, compare the new rate quotes to your existing rates to see if a cheaper price is available in Louisville. If you find a better price and change companies, make sure coverage does not lapse between policies.

- Fourth, provide written notification to your current company to cancel your current auto insurance policy. Submit payment along with a signed and completed policy application to your new company or agent. Once the paperwork is finalized, keep the new certificate of insurance along with your vehicle registration.

One thing to point out is that you’ll want to compare the same deductibles and limits on every price quote and and to get quotes from as many different insurance providers as possible. This provides a fair rate comparison and maximum price selection.

If you have a current car insurance policy or just want a better rate, use these techniques to shop for the lowest rates while maximizing coverage. Locating the best rates in Louisville can be much easier if you know how to start. Drivers only need to know the proper methods to shop for car insurance online.

Car insurance providers offering cheap prices in Kentucky

The companies in the list below offer free quotes in Kentucky. If you wish to find cheap auto insurance in Kentucky, we suggest you visit several of them in order to get a fair rate comparison.

Affordable Louisville auto insurance rates with discounts

Some insurers do not advertise every discount available very clearly, so the list below details a few of the more common and the harder-to-find discounts that may be available. If you are not receiving all the discounts you qualify for, it’s possible you qualify for a lower rate.

- More Vehicles More Savings – Buying insurance for multiple cars or trucks on a single policy can reduce rates for all insured vehicles.

- Home Ownership Discount – Owning your own home or condo can save a few bucks due to the fact that maintaining a home means you have a higher level of financial diligence.

- Safety Restraint Discount – Drivers who require all vehicle occupants to buckle their seat belts can save up to 10 percent (depending on the company) off the personal injury premium cost.

- Driver’s Ed – Cut your cost by having your teen driver enroll in driver’s education in school or through a local driver safety program.

- Distant Student Discount – Older children who attend college more than 100 miles from Louisville and won’t have access to an insured vehicle may qualify for this discount.

- Discounts for Good Drivers – Safe drivers may receive a discount up to 45% than drivers with accident claims.

- Federal Government Employee – Active or former government employment could provide a small rate reduction with a few auto insurance companies.

- Fewer Miles Equal More Savings – Maintaining low annual mileage may enable drivers to earn substantially lower premium rates.

- Buy New and Save – Adding a new car to your policy can get you a discount since new model year vehicles have better safety ratings.

You should keep in mind that most of the big mark downs will not be given to the entire policy premium. Some only apply to the cost of specific coverages such as physical damage coverage or medical payments. So when it seems like all those discounts means the company will pay you, it doesn’t quite work that way.

Companies and some of the premium reductions they offer can be read below.

- State Farm includes discounts for Steer Clear safe driver discount, good student, defensive driving training, multiple policy, and passive restraint.

- GEICO offers discounts for daytime running lights, air bags, federal employee, military active duty, anti-theft, emergency military deployment, and multi-vehicle.

- Liberty Mutual may have discounts that include teen driver discount, hybrid vehicle, newly married, multi-policy, preferred payment discount, good student, and exclusive group savings.

- The Hartford may offer discounts for driver training, anti-theft, bundle, vehicle fuel type, and defensive driver.

- MetLife policyholders can earn discounts including claim-free, good student, accident-free, defensive driver, multi-policy, good driver

- Progressive may include discounts for online signing, multi-policy, continuous coverage, multi-vehicle, good student, online quote discount, and homeowner.

When getting free Louisville car insurance quotes, it’s a good idea to every insurance company which credits you are entitled to. Some of the earlier mentioned discounts may not apply to policyholders in your area.

Comparing quotes from local Louisville insurance agencies

Some consumers still prefer to talk to a local agent and that can be a smart move Licensed agents are trained risk managers and help in the event of a claim. A good thing about comparing rate quotes online is the fact that drivers can get cheaper prices and still buy from a local agent. Buying from local insurance agents is still important in Louisville.

After filling out this form (opens in new window), your coverage information is submitted to participating agents in Louisville who will give competitive quotes for your insurance coverage. You never need to contact any agents because prices are sent to the email address you provide. If you wish to quote rates for a specific company, you just need to navigate to their website and complete a quote there.

Do you need an independent or exclusive auto insurance agent?

When searching for an insurance agent, it’s important to understand the different types of agents and how they can write your policy. Auto insurance agencies can be categorized as either independent (non-exclusive) or exclusive. Both can sell auto insurance policies, but it’s good to learn the difference between them because it can influence buying decisions.

Independent Auto Insurance Agencies

Agents in the independent channel do not write with just one company so they can write business with any number of different companies and potentially find a lower price. If they quote lower rates, the business is moved internally without you having to go to a different agency.

When comparison shopping, you will want to include rate quotes from independent agents to maximize your price options.

The following are independent agents in Louisville that may be able to provide rate quotes.

Braden Insurance Agency Inc.

3069 Breckenridge Ln – Louisville, KY 40220 – (502) 437-3926 – View Map

Nelson Insurance Group

2000 Envoy Cir # 2000 – Louisville, KY 40299 – (502) 736-7000 – View Map

Grant Insurance Agency, LLC

13000 Equity Pl #201 – Louisville, KY 40223 – (502) 254-3332 – View Map

Exclusive Agents

Exclusive agents can usually just insure with one company and some examples include Allstate, Farmers Insurance, State Farm, and AAA. They are unable to shop your coverage around so always compare other rates. Exclusive agents are usually quite knowledgeable on what they offer which helps overcome the inability to quote other rates.

Below is a short list of exclusive insurance agencies in Louisville who can help you get price quote information.

Terryl McCray – State Farm Insurance Agent

1827 W Broadway – Louisville, KY 40203 – (502) 774-3373 – View Map

Dick Newton – State Farm Insurance Agent

3110 Taylorsville Rd – Louisville, KY 40205 – (502) 458-9543 – View Map

Ivy Brito – State Farm Insurance Agent

4919 Dixie Hwy b – Louisville, KY 40216 – (502) 449-1362 – View Map

Finding the right car insurance agent needs to be determined by more than just a cheap quote. The following questions are important to ask.

- Which companies can they place coverage with?

- Will they give you a referral list?

- How much training do they have in personal risk management?

- Does the agency have a good rating with the Better Business Bureau?

- Are they actively involved in the community?

After receiving acceptable answers to any questions you have as well as a affordable price, it’s possible that you found an insurance agency that meets your needs to adequately provide auto insurance.

Auto insurance policy coverages for a Nissan Leaf

Knowing the specifics of your auto insurance policy can help you determine the best coverages and the correct deductibles and limits. Auto insurance terms can be ambiguous and even agents have difficulty translating policy wording. Below you’ll find the normal coverages offered by auto insurance companies.

Auto collision coverage

Collision insurance will pay to fix damage to your Leaf resulting from a collision with another vehicle or an object, but not an animal. You will need to pay your deductible and then insurance will cover the remainder.

Collision coverage pays for claims such as colliding with a tree, crashing into a ditch, hitting a parking meter, hitting a mailbox and backing into a parked car. This coverage can be expensive, so consider removing coverage from vehicles that are 8 years or older. You can also bump up the deductible on your Leaf to save money on collision insurance.

Uninsured Motorist or Underinsured Motorist insurance

Uninsured or Underinsured Motorist coverage provides protection when the “other guys” are uninsured or don’t have enough coverage. Covered losses include injuries to you and your family and damage to your Nissan Leaf.

Since many Kentucky drivers only carry the minimum required liability limits (25/50/10), it doesn’t take a major accident to exceed their coverage limits. For this reason, having high UM/UIM coverages is important protection for you and your family. Most of the time your uninsured/underinsured motorist coverages are identical to your policy’s liability coverage.

Liability auto insurance

This coverage protects you from damage that occurs to other’s property or people by causing an accident. It protects YOU against claims from other people. It does not cover your injuries or vehicle damage.

Coverage consists of three different limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You might see liability limits of 25/50/10 which means a limit of $25,000 per injured person, a total of $50,000 of bodily injury coverage per accident, and property damage coverage for $10,000. Another option is a combined single limit or CSL which combines the three limits into one amount and claims can be made without the split limit restrictions.

Liability can pay for claims such as legal defense fees, emergency aid, medical expenses and repair bills for other people’s vehicles. How much liability should you purchase? That is a personal decision, but buy higher limits if possible. Kentucky state law requires minimum liability limits of 25/50/10 but you should consider buying more coverage.

The next chart demonstrates why minimum state limits may not be adequate.

Insurance for medical payments

Medical payments and Personal Injury Protection insurance provide coverage for short-term medical expenses for surgery, EMT expenses, hospital visits, dental work and rehabilitation expenses. They are often used to cover expenses not covered by your health insurance program or if there is no health insurance coverage. They cover not only the driver but also the vehicle occupants as well as any family member struck as a pedestrian. Personal injury protection coverage is only offered in select states and may carry a deductible

Comprehensive coverage (or Other than Collision)

Comprehensive insurance covers damage that is not covered by collision coverage. A deductible will apply and then insurance will cover the rest of the damage.

Comprehensive coverage pays for claims such as damage from a tornado or hurricane, hitting a deer, rock chips in glass and falling objects. The highest amount you’ll receive from a claim is the cash value of the vehicle, so if it’s not worth much more than your deductible consider dropping full coverage.

Smart consumers save more

Some insurance providers may not have the ability to get a quote online and most of the time these small insurance companies sell through independent agents. Lower-priced auto insurance in Louisville can be found from both online companies as well as from independent agents in Louisville, and you should compare price quotes from both to have the best chance of lowering rates.

When you buy Louisville car insurance online, make sure you don’t buy less coverage just to save a little money. In many instances, consumers will sacrifice full coverage to discover at claim time that saving that couple of dollars actually costed them tens of thousands. The ultimate goal is to find the BEST coverage for the lowest price and still be able to protect your assets.

You just read a lot of techniques to shop for Nissan Leaf insurance online. The key concept to understand is the more rate comparisons you have, the better your chances of lowering your prices. You may even discover the lowest premium rates are with some of the lesser-known companies. They can often provide lower prices in certain areas than the large multi-state companies such as Progressive and GEICO.

More information can be read below:

- Teen Driving and Texting (State Farm)

- What Car Insurance is Cheapest for Welfare Recipients in Louisville? (FAQ)

- How Much is Auto Insurance for Safe Drivers in Louisville? (FAQ)

- What is a Telematics Device? (Allstate)

- New Honda safety features benefit drivers of all ages (Insurance Institute for Highway Safety)