Everyone knows that car insurance companies don’t want you to look for cheaper rates. People who shop around for the cheapest rate are inclined to switch to a new company because there is a significant possibility of finding discount prices. A study showed that people who did price comparisons regularly saved on average $3,450 over four years as compared to drivers who never compared other company’s rates.

Everyone knows that car insurance companies don’t want you to look for cheaper rates. People who shop around for the cheapest rate are inclined to switch to a new company because there is a significant possibility of finding discount prices. A study showed that people who did price comparisons regularly saved on average $3,450 over four years as compared to drivers who never compared other company’s rates.

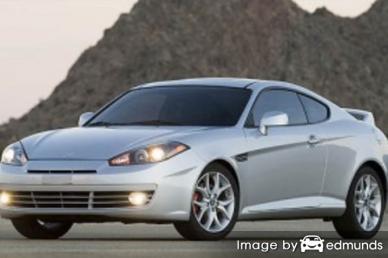

If finding the cheapest price for Hyundai Tiburon insurance is your ultimate target, then understanding how to find companies and compare insurance coverage can help you succeed in saving money.

If you want to save the most money, the best way to get discount car insurance rates in Louisville is to regularly compare quotes from different companies in Kentucky.

Step 1: Gain an understanding of auto insurance and the changes you can make to prevent expensive coverage. Many rating criteria that cause high rates like accidents, careless driving, and a substandard credit history can be improved by making minor changes in your lifestyle. Keep reading for information to help reduce premium rates and get additional discounts.

Step 2: Get rate quotes from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only provide price estimates from one company like GEICO or Farmers Insurance, while agents who are independent can provide rate quotes for a wide range of companies.

Step 3: Compare the new rate quotes to your current policy to see if you can save by switching companies. If you can save some money and make a switch, make sure there is no lapse between the expiration of your current policy and the new one.

A valuable tip to remember is to try to compare identical coverage information on each quote request and and to analyze all possible companies. Doing this ensures a level playing field and a better comparison of the market.

Locating the best rates in Louisville seems hard but is not really that difficult. If you’re already insured or need new coverage, you will benefit by learning to reduce the price you pay without reducing protection. You just have to know the most efficient way to compare insurance rates from many companies at once.

Finding low cost insurance rates can be quick and easy. Just take the time comparing rates to discover which company has affordable Hyundai Tiburon insurance quotes.

It’s so simple to compare insurance quotes online takes the place of having to call or drive to insurance agencies in your area. Quoting Hyundai Tiburon insurance online has made agencies unnecessary unless you have a complicated situation and need the professional guidance that you can only get from talking to an agent. You can, however, price shop your coverage online but have your policy serviced through an agent.

The following companies provide price comparisons in Louisville, KY. To buy cheap auto insurance in Louisville, KY, it’s highly recommended you visit as many as you can to get a more complete price comparison.

Take these eight policy discounts and save on Hyundai Tiburon insurance in Louisville

Car insurance is not inexpensive, but you may find discounts that can drop the cost substantially. A few discounts will be applied when you get a quote, but a few need to be asked about prior to receiving the credit.

- No Claims – Insureds with no claims or accidents pay less compared to frequent claim filers.

- Theft Deterrent – Cars, trucks, and SUVs equipped with tracking devices and advanced anti-theft systems are stolen with less frequency so companies will give you a small discount.

- Own a Home – Simply owning a home can get you a discount because maintaining a house is proof of financial responsibility.

- Senior Citizens – Drivers that qualify as senior citizens can possibly qualify for a discount up to 10%.

- Telematics Data – Drivers who elect to allow driving data submission to analyze when and where they use their vehicle by using a telematic data system such as Allstate’s Drivewise and State Farm’s In-Drive system could see a rate decrease as long as they are good drivers.

- Active Service Discounts – Having a deployed family member can result in better premium rates.

- Multiple Cars – Purchasing coverage when you have multiple vehicles with one company qualifies for this discount.

- Multi-policy Discount – If you insure your home and vehicles with one company you may save as much as 10 to 15 percent.

Drivers should understand that most discounts do not apply to the whole policy. Most cut specific coverage prices like comp or med pay. Even though it may seem like you could get a free car insurance policy, you won’t be that lucky.

To view providers that offer many of these discounts in Louisville, follow this link.

Why auto insurance is not optional

Even though Louisville Tiburon insurance rates can get expensive, insurance serves a purpose in several ways.

- Most states have minimum liability requirements which means you are required to carry a specific level of liability coverage if you drive a vehicle. In Kentucky these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you have a lien on your Tiburon, it’s guaranteed your bank will require that you have physical damage coverage to ensure they get paid if you total the vehicle. If the policy lapses, the lender may have to buy a policy to insure your Hyundai at a much higher rate and force you to pay for it.

- Auto insurance protects not only your vehicle but also your financial assets. It also can pay for medical transport and hospital expenses incurred in an accident. Liability insurance, one of your policy coverages, also covers legal expenses if anyone sues you for causing an accident. If mother nature or an accident damages your car, collision and comprehensive (also known as other-than-collision) coverage will pay to repair the damage.

The benefits of buying enough insurance more than cancel out the cost, particularly for liability claims. According to a survey of 1,000 drivers, the average driver is wasting up to $830 a year so it’s very important to do a rate comparison at least once a year to be sure current rates are still competitive.

What if I want to buy from local Louisville car insurance agents?

Certain consumers prefer to sit down with an agent. Professional insurance agents are trained to spot inefficiencies and help you file claims. One of the benefits of comparing auto insurance online is you may find cheaper premium rates and also buy local.

To help locate an agent, after submitting this quick form, the coverage information is immediately sent to participating agents in Louisville who will gladly provide quotes for your coverage. You won’t even need to drive around because quoted prices will be sent immediately to you. If for some reason you want to compare rates for a specific company, you just need to go to their quote page and fill out their quote form.

To help locate an agent, after submitting this quick form, the coverage information is immediately sent to participating agents in Louisville who will gladly provide quotes for your coverage. You won’t even need to drive around because quoted prices will be sent immediately to you. If for some reason you want to compare rates for a specific company, you just need to go to their quote page and fill out their quote form.

Finding the right provider shouldn’t rely on just the quoted price. Some important questions to ask are:

- Are glass claims handled on-site or do you have to take your vehicle to a repair shop?

- How much will you save each year by using a higher deductible?

- Can you use your own choice of collision repair facility?

- Are they primarily personal or commercial lines agents in Louisville?

- Do the coverages you’re quoting properly cover your vehicle?

- Is there a Errors and Omissions policy in force?

- Do you work with a CSR or direct with the agent?

- Can they give you a list of client referrals?

Upon getting satisfactory answers to your questions as well as an affordable premium quote, most likely you have located a company that is professional and can adequately provide auto insurance. Just be aware that you are able to terminate coverage whenever you choose to so don’t feel you’re contractually obligated to a specific agent with no way to switch.

Car insurance coverage information

Having a good grasp of a insurance policy can be of help when determining the best coverages at the best deductibles and correct limits. The coverage terms in a policy can be difficult to understand and even agents have difficulty translating policy wording. These are the normal coverages available from insurance companies.

Liability

Liability insurance provides protection from damages or injuries you inflict on other’s property or people. Split limit liability has three limits of coverage: bodily injury per person, bodily injury per accident and property damage. You might see limits of 25/50/10 that translate to a $25,000 limit per person for injuries, a per accident bodily injury limit of $50,000, and $10,000 of coverage for damaged property.

Liability can pay for claims like funeral expenses, medical services and legal defense fees. How much liability should you purchase? That is up to you, but buy as large an amount as possible. Kentucky state minimum liability requirements are 25/50/10 but drivers should carry higher limits.

The chart below demonstrates why buying the state minimum limits may not provide you with enough coverage.

Coverage for medical expenses

Med pay and PIP coverage kick in for immediate expenses for things like EMT expenses, chiropractic care, dental work, pain medications and ambulance fees. They can be used in conjunction with a health insurance program or if there is no health insurance coverage. It covers both the driver and occupants as well as being hit by a car walking across the street. Personal injury protection coverage is not available in all states but can be used in place of medical payments coverage

Coverage for uninsured or underinsured drivers

Your UM/UIM coverage provides protection when the “other guys” either are underinsured or have no liability coverage at all. This coverage pays for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Because many people only purchase the least amount of liability that is required (25/50/10 in Kentucky), their liability coverage can quickly be exhausted. So UM/UIM coverage is a good idea.

Auto collision coverage

This coverage pays to fix your vehicle from damage caused by collision with an object or car. You will need to pay your deductible and the rest of the damage will be paid by collision coverage.

Collision insurance covers things like damaging your car on a curb, colliding with a tree and colliding with another moving vehicle. Collision is rather expensive coverage, so consider dropping it from lower value vehicles. It’s also possible to increase the deductible on your Tiburon to bring the cost down.

Comprehensive insurance

Comprehensive insurance coverage covers damage that is not covered by collision coverage. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage protects against things such as theft, fire damage, a tree branch falling on your vehicle and hitting a bird. The maximum amount you can receive from a comprehensive claim is the cash value of the vehicle, so if it’s not worth much more than your deductible it’s not worth carrying full coverage.